reverse sales tax calculator ontario

An online sales tax table for the canadian territories and provinces from year 2012 to 2022. This simple PST calculator will help to calculate PST or reverse PST.

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

No change on the HST rate as been made for Ontario in 2022.

. Tax rate for all canadian remain the same as in 2017. It is very easy to use it. Amount with sales tax 1 GST and PST rate combined100 Amount without sales tax Amount with sales taxes x GST rate100 Amount of GST in BC.

Select Your State Alberta British Columbia Manitoba New Brunswick Newfoundland and Labrador Nova Scotia Northwest Territories Nunavut Ontario Prince Edward Island Quebec Saskatchewan Yukon. See the article. If your total receipt amount was 5798 and you paid 107 percent in sales tax youd simply plug those numbers into our calculator to find out that your original price before tax was 5737.

Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. To calculate the total amount and sales taxes from a. On March 23 2017 the Saskatchewan PST as raised from 5 to 6.

Formula for calculating reverse GST and PST in BC. The following table provides the GST and HST provincial rates since July 1 2010. For instance in Palm Springs California the total sales tax percentage including state county and local taxes is 7 and 34 percent.

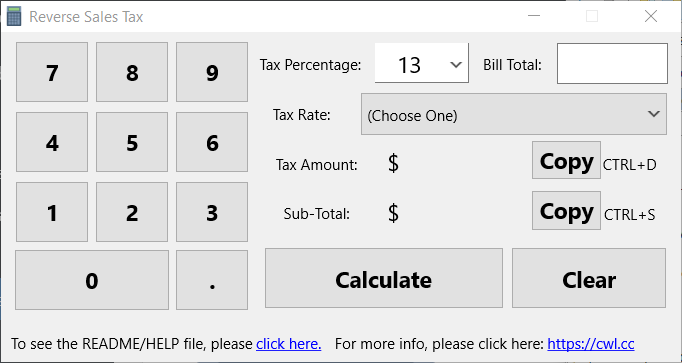

Amount without sales taxes x. Harmonized Sales Tax HST in Ontario What is the current 2022 HST rate in Ontario. Enter the sales tax percentage.

It ranges from 13 in Ontario to 15 in other provinces and is composed of a provincial tax and a. Harmonized Sales Tax HST The Harmonized Sales Tax or HST is a sales tax that is applied to most goods and services in a number of Canadian provinces. The second tab lets you calculate the taxes from a grand total including tax and gives you the subtotal before tax.

Enter the total amount that you wish to have calculated in order to determine tax on the sale. New Brunswick Newfoundland and Labrador Nova Scotia Ontario and Prince Edward Island. An online reverse sales tax Remove Sales tax calculation for residents of canadian territories and provinces with high accuracy.

History of sales taxes in Ontario. That entry would be 0775 for the percentage. New Brunswick Newfoundland and Labrador Nova Scotia Ontario Prince Edward Island HST Tax Rate.

You have a total price with HST included and want to find out a price without Harmonized Sales Tax. Sale Tax total sale net sale 105000 100000 5000. Just set it to the HST province that you want to reverse and enter in the after-tax dollar amount that you want to reverse.

17 rows HST reverse sales tax calculation or the Harmonized reverse Sales Tax calculator of 2016 for the entire Canada Ontario British Columbia Nova Scotia Newfoundland and Labrador and many more Canadian provinces. All Harmonized Sales Tax calculators on this site can be used as well as reverse HST calculator. This is very simple universal HST calculator for any Canadian province where Harmonized Sales Tax is used.

Select the province you need to calculate HST for and then enter any value you know HST value OR price including HST OR price exclusive HST the other values will be calculated instantly. Net Sale Amount Total Sale 1 sale tax rate 105000 105 100000. The HST is applied to most goods and services although there are some categories that are exempt or rebated from the HST.

The reverse sale tax will be calculated as following. From there it is a simple subtraction problem to figure out that you paid 61 cents in sales tax. Instead of using the reverse sales tax calculator you can compute this manually.

The information deisplayed in the Ontario Tax Brackets for 2022 is used for the 2022 Ontario Tax Calculator 2022 Income Tax in Ontario is calculated separately for Federal tax commitments and Ontario Province Tax commitments depending on where the individual tax return is filed in 2022 due to work location. The HST is made up of two components. Current HST rate for Ontario in 2022.

On July 1st 2010 HST Harmonized Sales. Current HST GST and PST rates table of 2022. 13 for Ontario 15 for others If you want a reverse HST calculator the above tool will do the trick.

As we can see the sale tax amount equal to 5000 which the same to above calculation. The HST for Ontario is calculated from Ontario rate 8 and Canada rate 5 for a total of 13. This rate is the same since july 1st 2010.

Current Provincial Sales Tax PST rates are. Provinces and Territories with HST. Where the supply is made learn about the place of supply rules.

Useful for figuring out sales taxes if you sell products with tax included or if you want to extract tax amounts from grand totals. Sales Taxes in Ontario. The only thing to remember in our Reverse Sales.

Ontario is one of the provinces in Canada that charges a Harmonized Sales Tax HST of 13. An 8 provincial. Amount without sales tax QST rate QST amount.

This calculator can be used as well as reverse HST calculator. Current 2022 HST rate in Ontario province is 13. Enter that total price into Price including HST input box at the bottom of calculator and you will get excluding HST value and HST value.

Sales taxes in Ontario where changed in 2010 then instead of GST and PST was introduced Harmonized sales tax HST. Amount without sales tax GST rate GST amount. 5 Federal part and 8 Provincial Part.

The rate you will charge depends on different factors see. You can use this method to find the original price of an item after a. Here is how the total is calculated before sales tax.

To find the original price of an item you need this formula. This reverse tax calculator will help you to know the purchasesell amount before and after tax apply. OP with sales tax OP tax rate in decimal form 1 But theres also another method to find an items original price.

Who the supply is made to to learn about who may not pay the GSTHST. The HST was adopted in Ontario on July 1st 2010. Canadian Sales Taxes From 2012 to 2022.

Type of supply learn about what supplies are taxable or not.

Reverse Gst Hst Pst Qst Calculator 2022 All Provinces In Canada

Reverse Sales Tax Calculator 100 Free Calculators Io

How To Find Original Price Tax 1 Youtube

Reverse Sales Tax Calculator 100 Free Calculators Io

Oklahoma Sales Tax Calculator Reverse Sales Dremployee

Reverse Tax Calculator Youtube

Quebec Sales Tax Gst Qst Calculator 2022 Wowa Ca

Ontario Sales Tax Hst Calculator 2022 Wowa Ca

![]()

Sales Tax Canada Calculator On The App Store

Canada Sales Tax Calculator By Tardent Apps Inc

Canada Sales Tax Gst Hst Calculator Wowa Ca

Reverse Hst Gst Calculator All Provinces Rates Wowa Ca

Ontario Sales Tax Calculator Hst Gst Pst By Chewy Applications

Sales Tax Canada Calculator On The App Store

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price